•

Comp-Based Investing: How Modern Investors Are Outpacing Appraisers

Comp-based investing is a strategy that takes a data-driven approach, focusing on using comparative market analysis (CMA) to determine the true market value of potential…

Comp-based investing is a strategy that takes a data-driven approach, focusing on using comparative market analysis (CMA) to determine the true market value of potential investment properties. It’s considered a newer approach, favored by most tech-forward investors over the traditional method of property appraisals.

Although they dominated the industry for decades, property appraisals aren’t infallible and can take longer to generate. By comparison, investors can use comp-based strategies, leveraging recent sales data of comparable nearby properties, to determine if a property is over- or under-valued, what a competitive offer would be, and how the property could work with their preferred exit strategy.

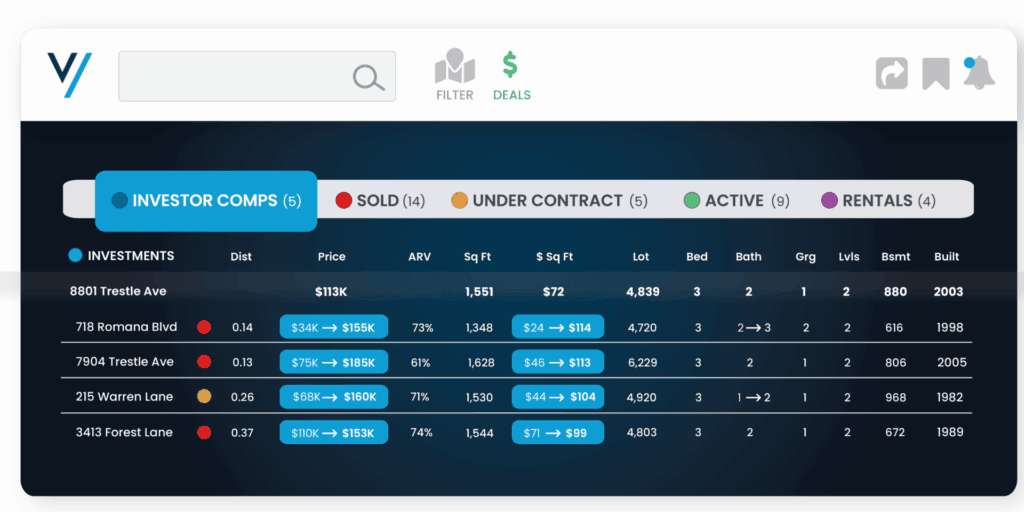

Investors can use comp-based strategies to have greater control over their portfolio, making faster and more informed decisions, particularly in fast-moving markets. At Privy, our LiveCMA tool gives you a 360-degree view of your chosen market for accurate comparative market analysis that ensures you get the best deal.

Modern vs. Traditional Appraisal Methods

Traditional property appraisals are still a requirement for mortgage and loan lenders, providing information for formal valuations. However, they’re no longer reliable as your sole data source in today’s fast-paced real estate market.

Appraisals require a physical inspection, taking time and resources, delaying your decision-making. Most appraisers don’t have access to up-to-date market information, and they don’t consider the full picture, such as off-market trends and comps that investors are more focused on, such as after-repair value (ARV).

Appraisers follow a standardized methodology, including a physical inspection, market data review, and comparable sales analysis, accounting for any adjustments. Reconciling this data allows them to arrive at a final valuation. They exist primarily to provide mortgage lenders and insurance firms with a standardized valuation for legal and taxation purposes.

By comparison, you can conduct a CMA at the touch of a button with Privy, giving you access to real-time, accurate data about comparable properties. Privy utilizes direct-to-MLS data, public records, and information about off-market deals and investor activity to give you a complete picture of the local market. While an appraisal only gives you a number, data-driven platforms like Privy give the full picture.

The Limitations of Traditional Appraisals

Most property appraisals can take at least several days to complete, from scheduling the physical inspection to verifying comparable sales and completing a final report. If you’re an investor focused on a competitive market, just a few days spent waiting for an appraisal could cost you to miss out on a potentially lucrative deal.

The time delay is one of the major drawbacks to traditional appraisals, but the data these professionals use can also be out-of-date. In a hot market, prices can fluctuate on a weekly basis. It’s possible for appraisals to be conducted using out-of-date data, resulting in final valuations that do not reflect the property’s true value.

In a tech-driven world, real estate deals are moving faster than ever. Investors simply no longer have the time to wait days or weeks for a potentially out-of-date appraisal. It’s crucial investors know the actual market value of a property to inform their financial decisions and prevent them from overpaying. An out-of-date valuation from an appraisal can create a tricky financial situation for investors focused on flipping properties, especially those with tighter margins.

Comparative market analysis fills this gap by giving investors access to up-to-the-minute data at the touch of a button. Having access to instant comps allows investors to stay ahead of the competition and quickly determine whether a potential deal is worth further exploration.

Challenges Appraisers Face in Fast-Moving Markets

In slower markets with less volatility, appraisers are more likely to have access to accurate information. The main challenge appraisers face is in fast-moving markets where prices fluctuate daily. Rapid price appreciation may make it difficult for appraisers to find recently sold properties that are truly comparable, resulting in potential undervaluation.

By comparison, similar challenges exist in areas with low inventory or where demand outstrips supply, as limited comparable sales may require them to make more adjustments during their calculations. The same challenge also exists for more unique properties, including historic estates and new builds.

While appraisers are meant to be neutral, they face external pressures from sellers, buyers, and lenders, who all have reasons for preferring a higher or lower valuation. These challenges create scenarios where valuation gaps exist with appraisals producing valuations that underestimate a property’s true market price.

The Rise of Modern Comp-Based Investing

Modern comp-based investing has emerged as an alternative strategy to traditional appraisals. These tech-savvy investors rely on data-driven insights to conduct immediate comp analysis for potential investment properties.

Privy provides investors with real-time market insights for faster and more accurate valuations, while also integrating a broader dataset than what appraisers have access to, including off-market deals and investor activity. Our comprehensive data empowers investors to read the market in real time, putting them ahead of the competition with instant alerts and expert insights aligned to their investing preferences.

Privy’s investor-focused data gives you the tools to automate your comparative market analysis to make smarter and faster investment decisions. You no longer need to rely on receiving sales data from a local agent or crunching the numbers yourself. Privy will automatically pull relevant comps, including sold properties, active listings, and properties under contract, to give you the full picture.

You can get more accurate results in just minutes with Privy than waiting days for a traditional appraisal.

Real Estate Platforms Offer a Broader Dataset

The appeal of a tech-forward platform like Privy vs. a traditional appraisal comes from its broader range of data. It’s not limited to just MLS data, instead pulling information from off-market properties, pocket listings, and investor activity. These broader insights are crucial for helping investors understand the true value of a property, including its after-repair value.

This information can also enable investors to determine if a purchase is worth making by showcasing potential profit margins for comparable flipped properties. By tracking investor activity, platforms like Privy also take the guesswork out of property valuation, enabling investors to mimic proven strategies to streamline their decision-making.

Where this technology outperforms traditional appraisals is its ability to determine the true valuation of a property as it sits and what it’s likely to sell for after cosmetic or extensive repairs.

With up-to-the-minute data, Privy enables investors to receive alerts for new comps in areas of interest and watch live investor activity in their target neighborhoods. Investors can spot opportunities before they even hit the market, allowing them to make faster and more competitive offers to close deals sooner.

How Investors Are Outpacing Appraisers

Comp-based investors are outpacing appraisers and outperforming other investors who aren’t leveraging the potential of technology like Privy’s LiveCMA. Switching from a traditional appraisal to direct-to-MLS data to automatically run comps enables investors to acquire properties faster with better deal pricing.

If you’re relying on appraisers to help you determine the true market value of your potential investments, you’ll miss out on opportunities and fall behind your competitors. Without accurate market insights, you might fall into common investor traps, including overpaying in hot markets.

Here are 5 examples of how to use comp-based investing for different portfolio types:

- Maximizing cash flow for rental property

Using occupancy levels and sales pricing to choose a target area and conducting comps for rental properties can help you identify opportunities with high cash-on-cash returns. Having up-to-the-minute data can enable investors to use comp data to spot a single-family residential property priced at a 7% cap rate in a neighborhood where similar properties are being rented for 10%. Understanding the current market gives investors negotiating power to get the best purchase price to guarantee positive cash flow.

- Fast acquisitions in a hot market

In so-called “hot markets”, properties can sell the day they’re put up for sale. You don’t have time to wait for an appraiser, especially if you find a rare gem, such as an undervalued townhouse or condo in an area with rapid appreciation. By assessing the ARVs of comparable properties, accounting for repair costs, investors may be able to make fast acquisitions with a competitive offer, making it easier to flip and sell for a higher gross profit.

- Early entry into up-and-coming markets

As an investor, you want to be ahead of the crowd. The best opportunities for your investment portfolio are just before a market grabs mainstream attention. By tracking investor data and analyzing comps for off-market and pending listings, investors can spot emerging markets early. This comp-based investing strategy is ideal for those searching for new construction opportunities or who want to tear down and redevelop an existing property.

- Prevents overpaying, while staying competitive

Comp-based investing gives entrepreneurs and investors insights to understand the true market value of their potential investments. They’re less tempted to overbid if they fall into a bidding war or are swept away in the turbulence of a hot market. By quickly comping similar properties that have recently sold, including their sales price vs. the asking price, investors can instantly identify inflated listing prices and cap their offer at a price that ensures they still make their desired return.

- Rebalancing Portfolios Based on Neighborhood Shifts

Neighborhoods rarely remain stagnant. What was a “hot market” in 2020 may no longer be as attractive for potential homebuyers. Alternatively, neighborhoods where investors entered the market early could now be experiencing peak demand, making it an ideal time to maximize the investor’s return by selling the property.

A comp-based investing strategy enables investors to regularly analyze comps in the neighborhoods where they have properties, allowing them to determine their short and long-term plans for their assets. This method enables investors to continue rebalancing their portfolio as neighborhood demand shifts, allowing them to reallocate capital efficiently.

Combining comp-based investing with real-time data and comprehensive analytics allows investors to negotiate smarter and maximize returns in ways that traditional appraisal-focused strategies can never replicate.

How to Adopt Comp-Based Investing Strategies

The benefit of comp-based investing is that it empowers investors to analyze every aspect of a potential deal, instead of just receiving a price per square foot. While an appraisal can be a good baseline, the same information can be calculated more accurately and faster with a LiveCMA.

Privy gives investors in-depth insights to support their comp-based strategy, including days-on-market trends, flip frequency, and investor activity data. It gives you a 4D view of what’s happening in the market in practical terms.

If you’re adopting a comp-based investing strategy, you’ll want to go beyond the numbers. It’s important to look at before and after photos of your comparable properties to understand the scope of renovations and research the typical acquisition-to-resale timeline to correctly set your expectations.

It’s crucial to combine comps with other metrics, including your maximum allowable office (MAO), which involves reverse-engineering your offer price to ensure you can achieve your desired profit margin. You can also use comps to assess the potential of alternative investment strategies, including the buy, rehab, rent, refinance, and repeat method (BRRRR).

Traditional appraisals provide a formal and regulated valuation that is still required in many real estate transactions, particularly if you require a mortgage or an insurance policy. However, appraisals are not an ideal way to inform your investment decision-making as they rely heavily on often out-of-date historical data and take days or weeks to provide a final valuation.

Discover Comp-Based Investing with Privy’s Comprehensive Data and LiveCMA Tools

The inherent limitations of traditional appraisals make them unsuitable for most markets, particularly those with short DOM timelines and high investor activity. Platforms like Privy fill the gap by making comp-based investing possible with real-time insights and broader datasets that provide accurate market valuations. Instead of waiting weeks for a standardized appraisal, you can determine the true value of a property in just minutes at the touch of a button.

Comp-based investing enables tech-focused investors to outperform their competition by avoiding overpaying in hot markets, while being able to identify undervalued properties and make smarter decisions faster.

Ready to feel the benefits of comp-based investing? Attend an on-demand demo to see Privy’s investor-focused data in action and for a guided tour of Privy’s features, showing you how to maximize your investment strategy with tips on how to use our LiveCMA tool.